The initial public offer (IPO) of Tata Tech and Indian Renewable Energy Development Agency (IREDA) had given bumper profits to its investors on the very first day. Tata Tech's IPO had risen from 140 percent to 180 percent on the first day. Whereas IREDA had given 87.5 percent retcon. The issue price of Tata Tech was Rs 500. However, today on December 4, this share opened at a price of Rs 1,192.05. On December 1, it had touched the level of Rs 1,400. Similarly, the issue price of IRDEA was Rs 32 and today this share opened at the level of Rs 65.15.

At least 15 stocks that came this year recorded a huge rise of 80-100 percent on the day of their listing. Many investors invest in IPOs only for listing gains. However, if you also sell shares to earn profit on the day of listing, then you should understand the mathematics of tax related to it. Holding stock for a day is taxed the same as other stocks, but due to different circumstances of purchase, the tax is slightly different.

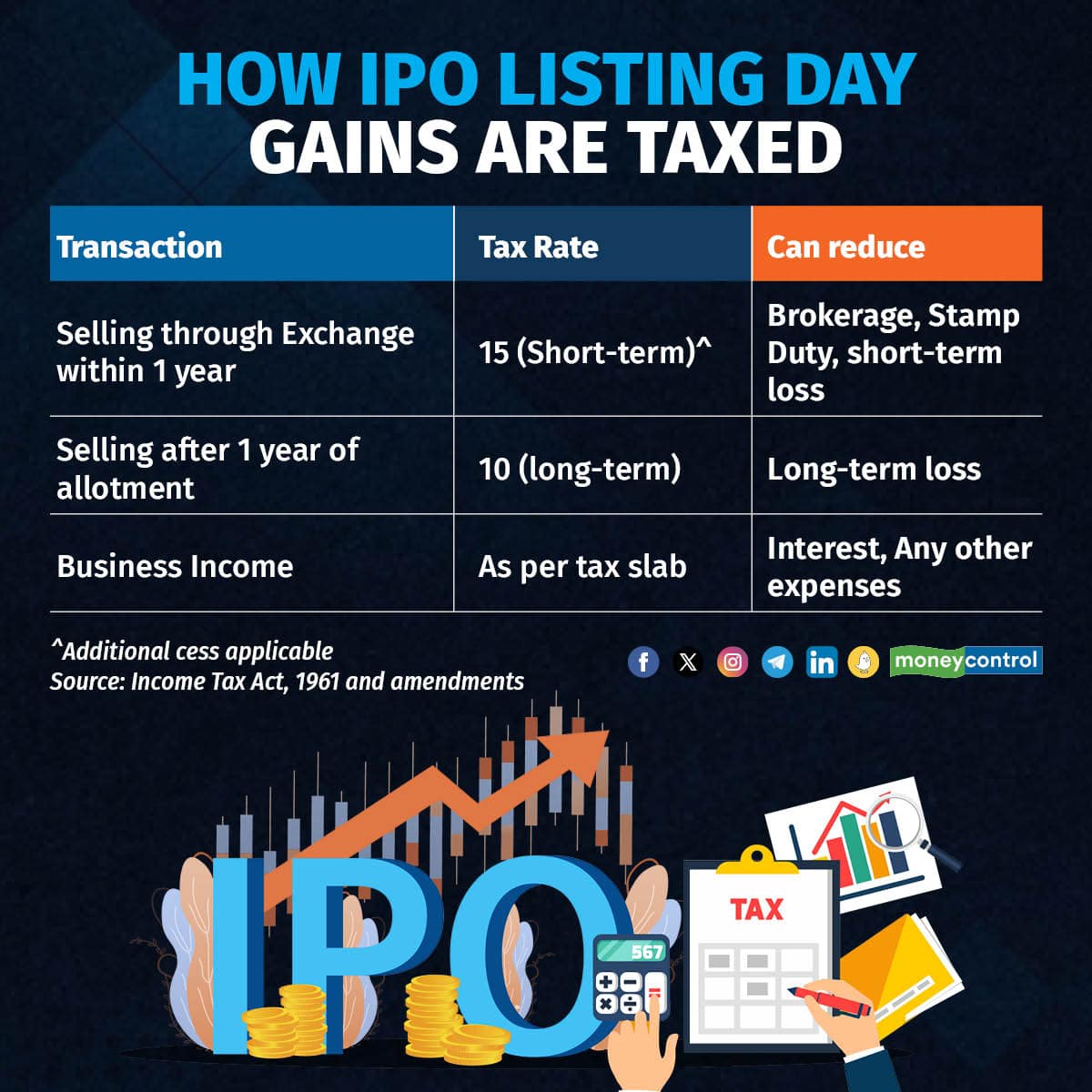

tax rates

Since you have sold the shares within a year of receiving them, the profit from share sale will be charged as “short-term capital gain”. Therefore, you will have to pay 15 percent tax along with Education and Higher Education Cess. If you hold these shares for a year or more, the tax rate will be 10 percent. Therefore, shares purchased during IPO will be counted as long term shares only after one year. Like Tata Tech shares acquired during IPO will be long term shares from 29 November 2024. This is different from the rest of the unlisted shares, which are counted in the long term after 3 years.

Also read- Market cap record of BSE listed companies at Rs 343.48 lakh crore, know details

low income people

Many senior citizens and low income people had applied for this IPO. Under the rules, the basic limit of tax exemption is Rs 2.5 lakh for general citizens, Rs 3 lakh for senior citizens (60-80 years) and Rs 5 lakh for very senior citizens (80 years and above). In simple words, if your income is below this limit then you do not have to pay any income tax.

Whereas if you are a senior citizen or very senior citizen and if your listing day profit is less than this basic limit, then you will not have to pay any income tax on the sale of your shares. Just remember that if you are an NRI, you cannot avail this exemption.

How can you understate profits?

The good news is that some of your profits can be offset by fees and other losses. For individual investors, the amount of application fees is not taxable. Similarly, the amount paid to brokerage can also be deducted from the profits. Additionally, if you have suffered a loss while selling any other assets, you can adjust that loss from your IPO profits.

You can understand from the chart given below how tax is levied on selling shares received in IPO on the day of listing.